We make getting the most out of your assets simple

Anesco offers a complete data-driven revenue optimisation service for storage and renewable assets, enabling green investment in the UK power sector and accelerating the energy transition.

Energy markets are complicated, but our service makes getting the most out of your assets simple; whether you have one battery, or a portfolio of renewable assets spread across multiple sites.

Using bespoke models and our inhouse energy trading platform, we forecast the short-term revenue potential of each market and enter in and out of services, making trading decisions based on risk profiles, asset characteristics, maintenance schedules, and opportunity costs.

As specialist storage and energy traders, we focus on maximising returns while not ignoring the health and long-term revenue potential of the assets. Combined with our industry-leading O&M services, we provide an efficient and effective all-in-one maintenance and optimisation solution.

All-in-one-solution for asset maintenance and optimisation

In-house capability developed specifically for storage assets

Proven track record in securing market-leading revenue

Strongly data-driven approach, enables instant reaction to changing market dynamics

Comprehensive market and revenue forecasting and real-time reporting

Transparent and extensive asset performance analytics and competitor benchmarking

A complete data-driven revenue optimisation and trading service for storage and renewable assets.

Using bespoke models and software developed in-house, our expert analysts are constantly monitoring the energy markets to ensure that our customers’ assets are delivering the greatest potential returns and achieving their maximum potential.

We successful access and trade in a wide range of revenue streams, forecasting revenue potential and making trading decisions based on our advanced analytical capabilities. Whether that is by participating in intraday power trading (also known as the short-term wholesale power market), or long-term power trading on the power futures market.

This includes capitalising on revenue generating opportunities within:

- Ancillary Services – such as Firm Frequency Response (FFR) and Dynamic Containment

- Wholesale trading

- The Balancing Mechanism

- The Capacity Market

Asset maintenance and revenue optimisation

We work closely alongside our industry-leading O&M team to offer a complete solution for our customers under one roof. By working with one provider in this way, our customers benefit from a highly efficient and coordinated approach to the maintenance and optimisation of their assets, ensuring the assets are in peak condition and that no revenue is missed from suboptimal maintenance scheduling.

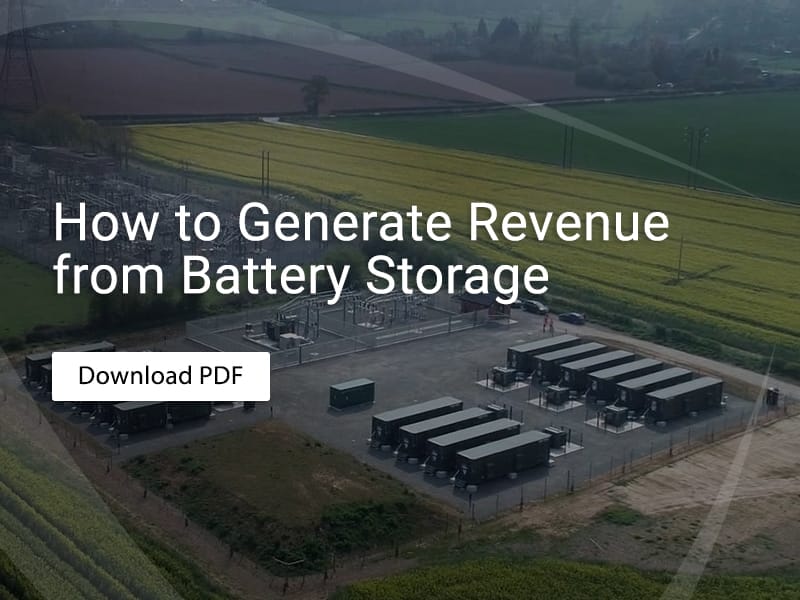

- Anesco operates 165MW of energy storage capacity in the UK and optimises 10 assets in the market

- We have consistently achieved top quartile financial performance from our assets across the various markets, with our proprietary ancillary service trading methodology delivering the majority of the income

- We continually benchmark ourselves against the competition, and ensure that we are leading the way in monetising storage assets in the UK

Market leader in building high performing assets

All this is strengthened by our vast experience in designing and building high performing assets. We truly understand batteries and renewable technologies.

In the past decade, we have managed some of the country’s largest and most complex renewable, storage and energy efficiency projects. This includes installing the first utility-scale battery storage in the UK, being the first to retain ROC accreditation for storage retrofit to existing solar farms, and developing the country’s first subsidy-free solar farm.

Blog

What is the future of battery storage in the UK?

Our CEO Mark Futyan took part in an expert panel discussion recently, exploring the ‘coming of age’ of energy storage in the UK and in particular, what the key challenges and opportunities are and how the market is expected to evolve moving forward. He shares his thoughts here.

Blog

Enhanced asset optimisation service with Modo’s marketing intelligence platform.

Anesco has signed up to the industry’s most advanced energy storage market intelligence platform, as part of ongoing moves to accelerate and strengthen its asset optimisation capabilities.

Blog

Standout year for Anesco’s O&M team.

2020 is proving to be a standout year for Anesco’s operations and maintenance team, with the service successfully entering new markets and a record number of assets now under management.